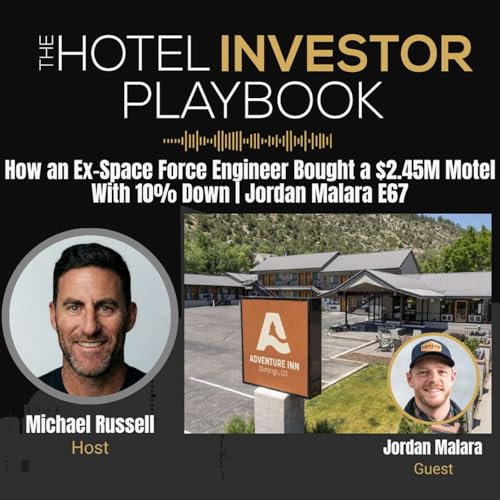

The Hotel Investor Playbook

Impossibile aggiungere al carrello

Puoi avere soltanto 50 titoli nel carrello per il checkout.

Riprova più tardi

Riprova più tardi

Rimozione dalla Lista desideri non riuscita.

Riprova più tardi

Non è stato possibile aggiungere il titolo alla Libreria

Per favore riprova

Non è stato possibile seguire il Podcast

Per favore riprova

Esecuzione del comando Non seguire più non riuscita

-

Letto da:

-

Di:

-

Michael Russell

A proposito di questo titolo

With an operator-first mindset, Michael brings a practical perspective to hotel investing. On the show, he breaks down what it actually takes to scale from short-term rentals into boutique hotels, covering deal sourcing, operations, capital strategy, and risk.

Each week, Michael shares real lessons from the field as he builds toward a $400 million real estate business, giving listeners an honest look at the decisions, challenges, and strategies behind the growth. Subscribe and follow along as he documents the journey in real time.

Episodi

-

1 ora e 7 min

1 ora e 7 minImpossibile aggiungere al carrello

Puoi avere soltanto 50 titoli nel carrello per il checkout.Riprova più tardiRiprova più tardiRimozione dalla Lista desideri non riuscita.

Riprova più tardiNon è stato possibile aggiungere il titolo alla Libreria

Per favore riprovaNon è stato possibile seguire il Podcast

Per favore riprovaEsecuzione del comando Non seguire più non riuscita

-

55 min

55 minImpossibile aggiungere al carrello

Puoi avere soltanto 50 titoli nel carrello per il checkout.Riprova più tardiRiprova più tardiRimozione dalla Lista desideri non riuscita.

Riprova più tardiNon è stato possibile aggiungere il titolo alla Libreria

Per favore riprovaNon è stato possibile seguire il Podcast

Per favore riprovaEsecuzione del comando Non seguire più non riuscita

-

1 ora e 1 min

1 ora e 1 minImpossibile aggiungere al carrello

Puoi avere soltanto 50 titoli nel carrello per il checkout.Riprova più tardiRiprova più tardiRimozione dalla Lista desideri non riuscita.

Riprova più tardiNon è stato possibile aggiungere il titolo alla Libreria

Per favore riprovaNon è stato possibile seguire il Podcast

Per favore riprovaEsecuzione del comando Non seguire più non riuscita

Ancora nessuna recensione